New Hampshire home prices up in April, but at slowest rate in two years

Sales were down slightly, but inventory inched up for single-family home sales in New Hampshire in April.

CONCORD, NH – Sales were down slightly, but inventory inched up for single-family home sales in New Hampshire in April.

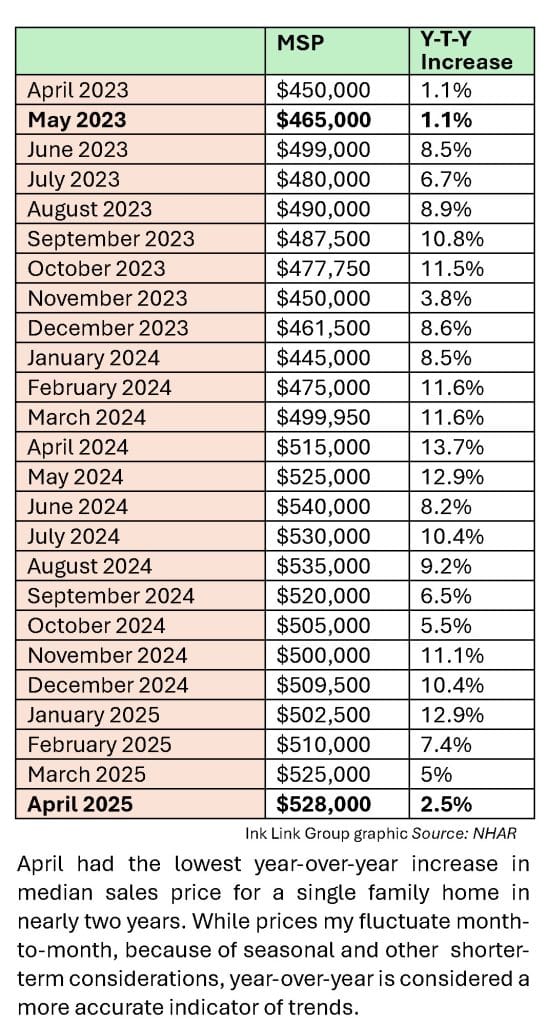

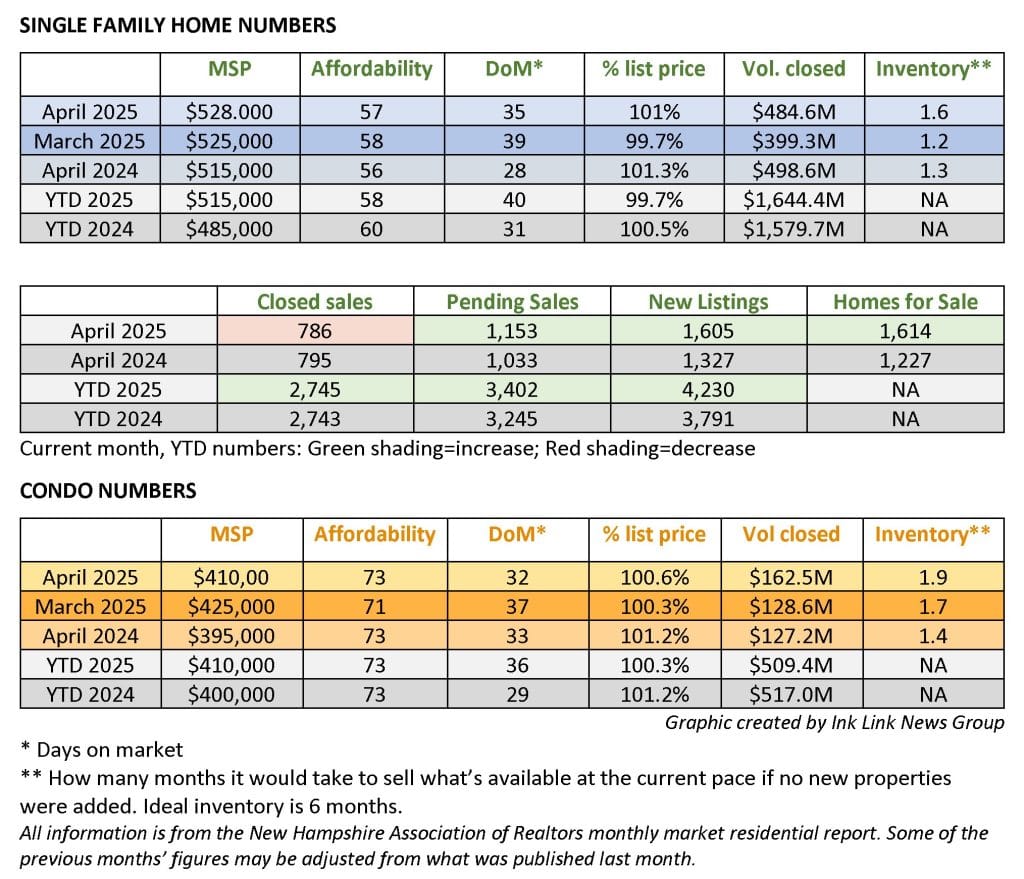

The median sales price for single-family homes sold last month was $528,000, a 2.5% increase over April 2024’s $515,000, according to the New Hampshire Association of Realtors monthly market report. Median price means that half of those who closed on a home in New Hampshire in April paid more, half paid less.

While it was an increase, it was the lowest rate year-over-year rate of increase in almost two years, when the May 2024 increase was 1.1% (to $465,000 from $460,000 in May 2022). While prices my fluctuate month-to-month, because of seasonal and other shorter-term considerations, year-over-year numbers are considered a more accurate indicator of trends.

There were 786 closed sales of existing single-family homes in New Hampshire in April, down 1.1% from 795 the year before.

While affordability is still low, and price high, there are more homes on the market, both pending (up 11.6%) and new listings (up 20.9%), than this time last year. Buyers are getting more time to shop around as well, as days on the market increased from an average of 28 a year ago to 35 last month.

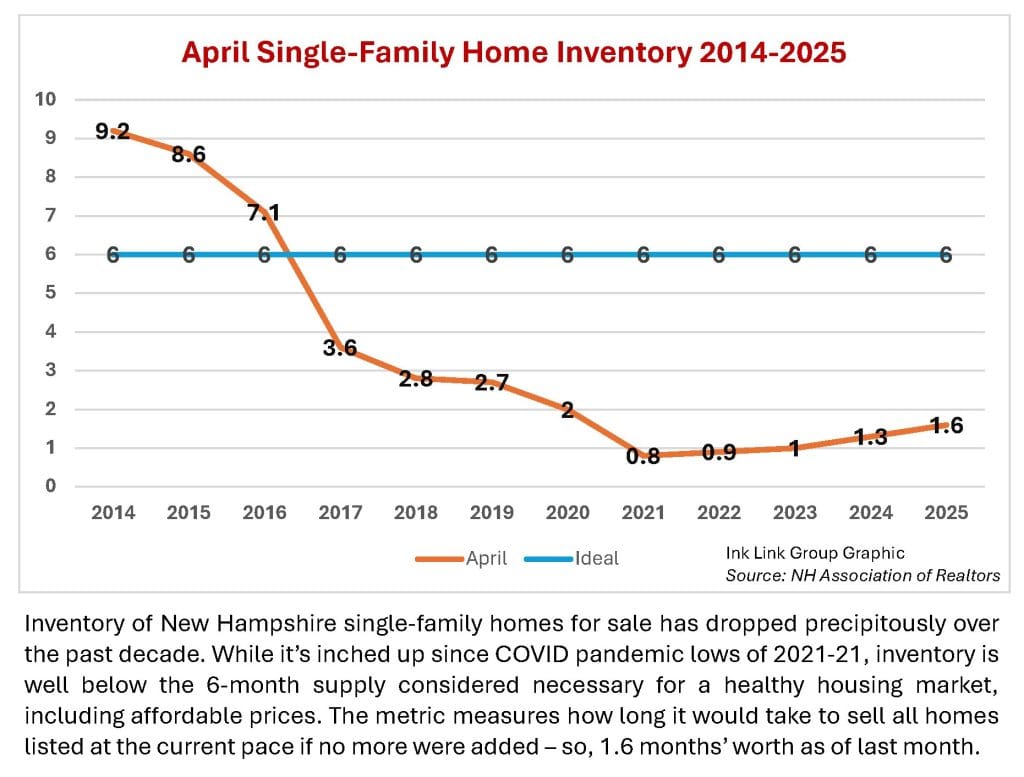

Inventory was 1.6 months’ supply, which means that if all the homes on the market sold at the current pace, with no new ones added, it would take 1.6 months to sell them all. A 6-months’ inventory is considered necessary for a stable market. Inventory has inched up every April for the last three years – it was 1.0 in 2023 and 1.3 last year. But that’s still far below what’s needed. The last time inventory was above 2 was October, when it was 2.1. The last time it was above 6 was July 2016, when it was 7.3.

Buyers paid 101% of list price in April, down from 101.3% a year ago. The affordability index was 57 in April, meaning that the state’s median income is 57% of what’s needed to afford monthly housing costs, including mortgage, property tax and insurance. Affordability index in April 2024 was 56.

Buyers hoping to score a better bargain the condo/townhouse market may have slightly better luck, but with prices that are still a budget-buster. The median sales price for condo/townhouses that closed in April was $410,000, up 3.8% from $395,000 a year earlier. April’s MSP was down from March’s $425,000.

Affordability index in April was 73, the same as April 2024. Buyers paid 100.6% of list price, compared to 101.2% the previous year. Properties were on the market an average 32 days, compared to 33 in April 2024.

New listings and homes for sale increased substantially, 14.4% and 28.1%, respectively, in the much smaller condo/townhouse market. There were 523 new listings, compared to 457 the year before, and a total 624 properties for sale, compared to 487.

Inventory was 1.9, compared to 1.4 a year ago.

There were 345 closed sales in April, up 5.5% from 327 in April 2024 and 409 pending sales, up 7.3%, from 381.

National, single-family home sales decreased 5.9% from April 2024, according to the National Association of Realters.

“Affordability challenges and economic uncertainty weigh[ed] on market activity,” the NAR said. Sales were down month-over-month in all four regions of the country, with the largest decline, 9.4%, in the West.

Total housing inventory in the U.S. increased 8.1%, by 1.33 million unites, to a 4.0-month supply.

“Although inventory is up nearly 20% from the same time last year, the additional supply has had little effect on home prices across much of the country,” the NAR said. The national median existing-home price was $403,700, up 2.7% from April 2024.