June NH home prices reach $538,000, affordability at all-time low

Home prices continued to rise and the ability of buyers to afford one continued to drop in New Hampshire in June, but the silver lining is that inventory is up slightly, according to the New Hampshire Association of Realtors monthly market report.

CONCORD, NH – Home prices continued to rise and the ability of buyers to afford one continued to drop in New Hampshire in June, but the silver lining is that inventory is up slightly, according to the New Hampshire Association of Realtors monthly market report.

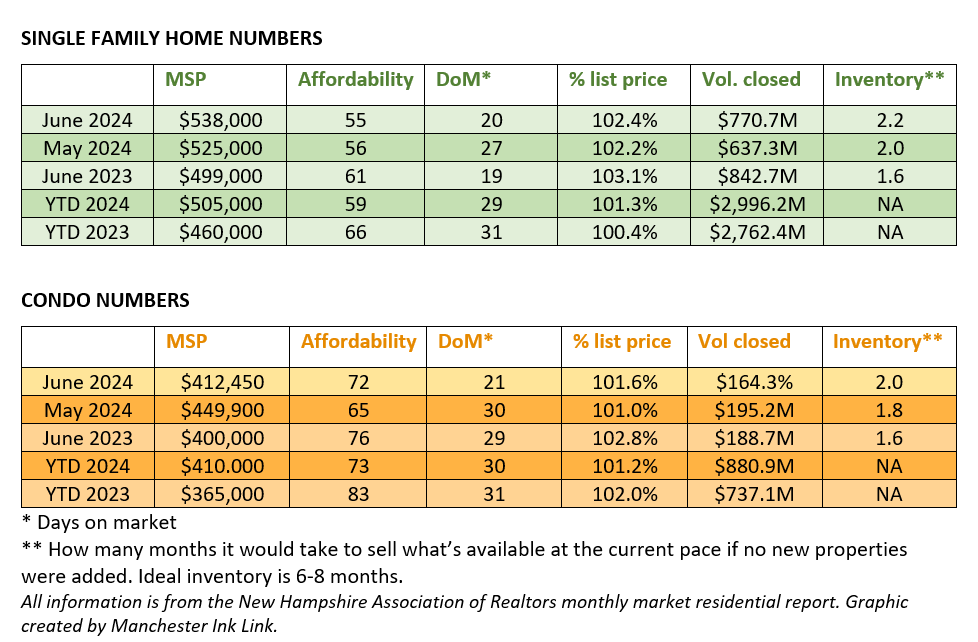

The median sales price for an existing – previously owned – single-family home in New Hampshire in June was $538,000, up from $499,000 in June 2023 and $525,000 in May. Median means that half of the homes sold for more, and half for less. Nationally, the MSP is $419,300, also an all-time high.

As house prices skyrocket, the affordability index has plummeted to a new low of 55. That means that the median area income, as determined by the U.S. Census Bureau, is 55% of what’s necessary to afford a monthly payment on a median-priced home, including current average interest rate, taxes and insurance.

Condo/townhouse prices sold for a median $412,450, with an affordability index of 72, that’s down from $449,900 in May, when there was an affordability index of 65. Because the market is so much smaller, the MSP price fluctuates more drastically.

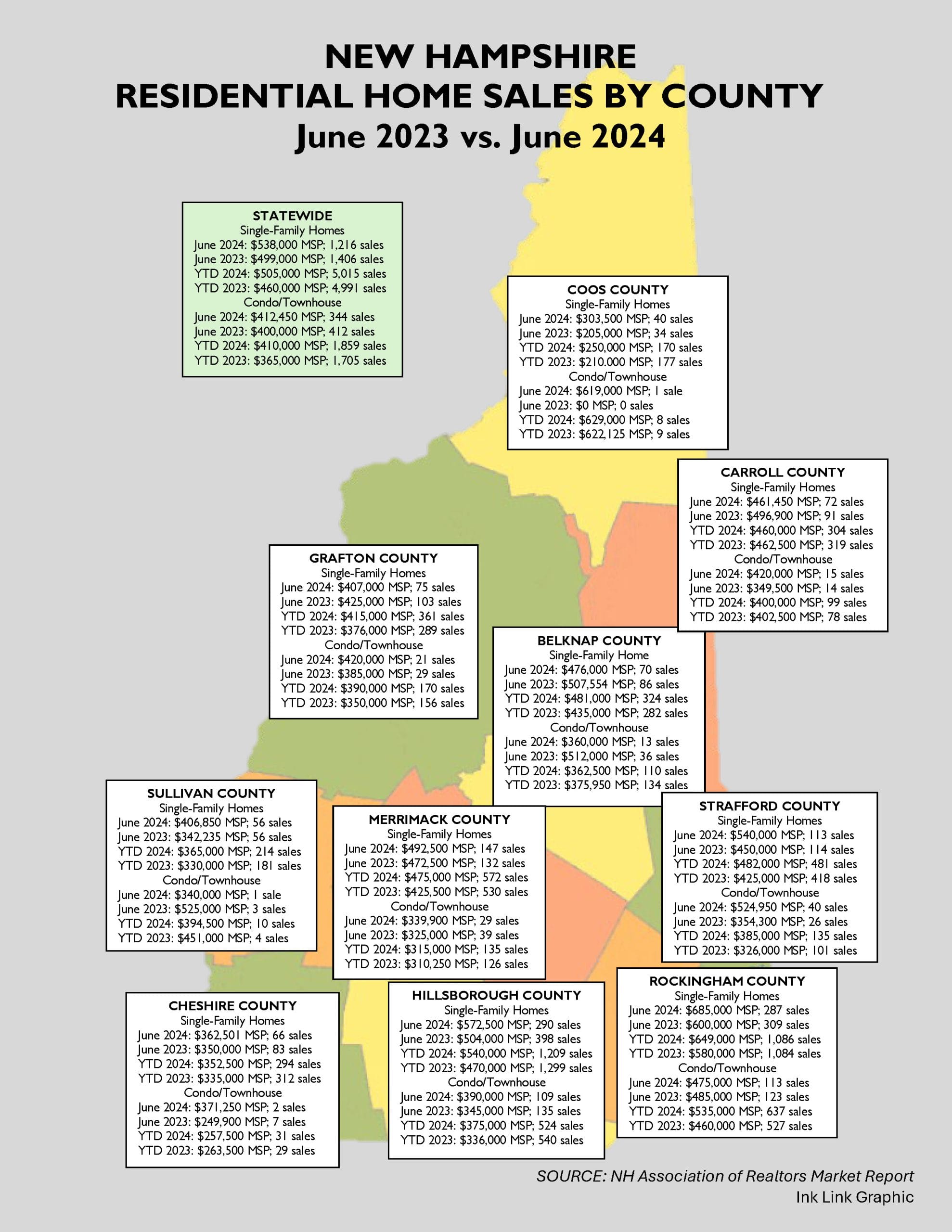

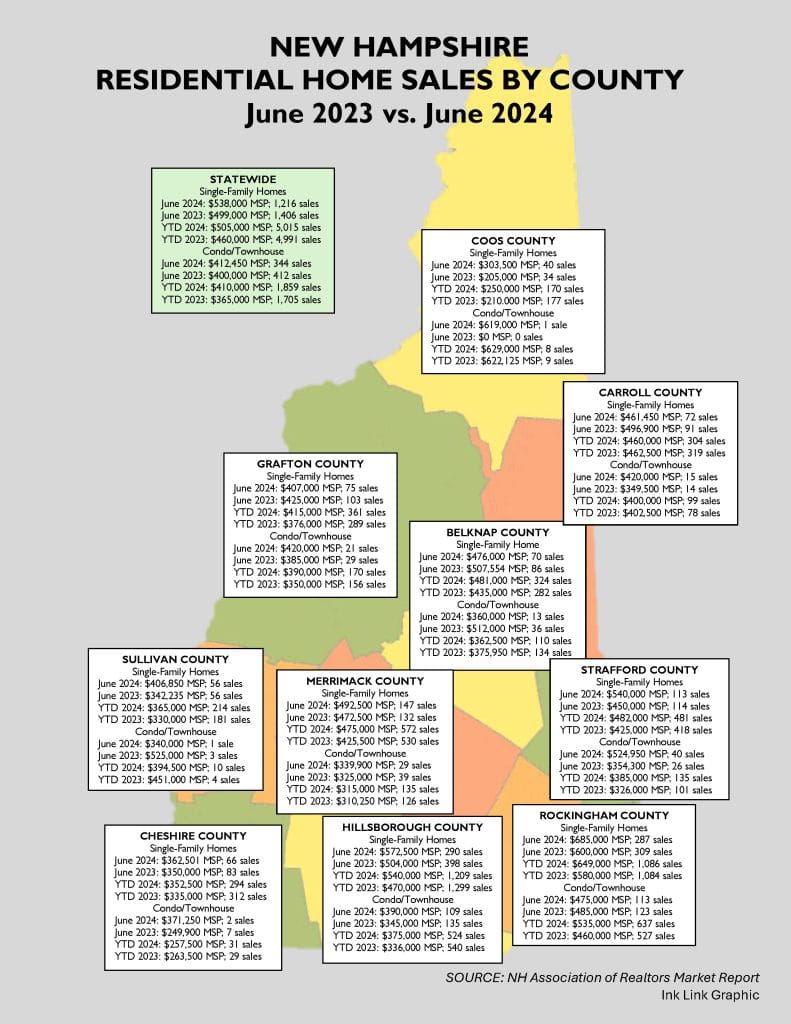

The single-family home MSP in Belknap, Carroll and Grafton showed a decrease from 2023 [see accompanying map]. The highest single-family home MSP in New Hampshire in June was in Rockingham County, at $695,000; the lowest was Coos County, at $303,500. Hillsborough, the state’s most populous county, had a June single-family home MSP of $572,500.

In what is traditionally one of the hottest months for home sales, sales of previously owned single-family homes were down 13.5% from a year ago, 1,216, compared to 1,406. Year-to-date numbers are slightly higher for 2024, 5,015 for the first six months of the year, compared to 4,991 for the first six months of 2023. Monetary volume of closed sales was down 8.5%, $770.7 million in June compared to $842.7 million in June 2023. But the year-to-date figures showed a 8.5% increase, $2,996.2 million for the first six months of 2024, compared to $2,762.4 million for the first six months of 2023.

Condo/townhouse closed sales were also down in June, a 16.5% decrease, with 344 compared to 412 a year ago, but they’re up 9% when comparing year-to-date numbers, 1,859 in the first six months of 2024 to 1,705 the first six months of 2023.

The silver lining for single-family homes is that available inventory increased slightly to 2.2, meaning if all listed homes sold for the same pace they’re selling now, with no new homes coming on the market, it would take 2.2 months to sell them all. That’s up from 1.6 a year ago and 2.1 in May. The last time inventory hit 2.2 was summer of 2022. Industry experts say an inventory of six months or more is ideal to stabilize the market.

Some other positive signs are a 7.2% increase in new listings over a year ago. There were 1,687 in June, as opposed to 1,584 in June 2023. The number of existing single-family homes in June was also up from a year ago, with 2,152 on the market compared to 1,569, an increase of 29.7%.

But buyers who can afford to buy a home have to act fast – single family homes spent an average 20 days on the market, up one day from 19 a year ago, but down a week from 27 in May. Buyers paid 102.4% of list price in June, compared to 103.1% 12 years ago and 102.2% in May.

Condo/townhouse new listings dropped 13.5% from 12 months ago. In June 431 were listed, compared to 498 in June 2023. Still, there were 658 overall for sale, compared to 520 in June 2023. Condo/townhouse properties are staying on the market for an average 21 days and buyers are paying 101.6% of list price.

Nationally, total housing inventory is on the increase, with 1.28 million units on the market as June began, 6.7% increase from the previous month. That represented a 3.7 months’ supply at the current sales pace, according to the National Association of Realtors. “However, the increase in supply has yet to temper home prices, which have continued to rise nationwide,” the NAR said.

Sales of previously owned homes were down 0.7% nationally in June from May, and 2.8% when compared to June 2023. Volume was down 12.9%, at $164.3 million this year compared to $188.7 million last year. It was up 19.5% for the first six months of 2024, however, $880.9 million compared to $737.1 million for the first six months of 2023.