It’s Your Money: 5 tips to future-proof your finances in 2025

This column was initially going to be about what consumers can expect in 2025, which is why it’s running so late this month. But as things have progressed, it’s pretty obvious that it’s a topic we can’t nail down until the dumpster fire goes from engulfed to at least smoldering.

FINANCE

IT’S YOUR MONEY

By Maureen Milliken

NEWS: There’s no telling what consumers will have to deal with in the coming year.

WHAT IT MEANS TO YOU: Put yourself in a financial position to weather any storm.

This column was initially going to be about what consumers can expect in 2025, which is why it’s running so late this month. But as things have progressed, it’s pretty obvious that it’s a topic we can’t nail down until the dumpster fire goes from engulfed to at least smoldering.

Because of all the uncertainty – particularly if you live paycheck-to-paycheck, rely on a federal program for your income or health care, get home heating assistance, plan to buy a house or rent an apartment, or even if you have a small business and were going to check out Small Business Administration programs – it’s important to future-proof your finances.

Future-proofing is essential for everyone. If you’re no-income, low-income, moderate-income or even wicked rich, you want to make sure that your finances will help sustain you in good times and bad. Still worried about the price of eggs? Who isn’t? Future-proofing will help keep you from lying awake at night thinking about it. If your solution is to just not buy eggs until the price comes down, you still need to future-proof for all the bigger stuff.

Here are the five top things you should do to help keep yourself on a steady course financially.

1. Budget

If you read this column regularly, you know that I’m a broken record on this topic. I understand that, especially if your bills outpace your income, it may be overwhelming and depressing to try to put it all down on paper. But having a budget is essential to spending less money, saving more and keeping your credit in a good place, no matter how much you make or how depressing your finances are.

A budget doesn’t have to be complicated. It just means keeping track of what money you have coming in and planning for what, when and how it will go out.

You can use fancy software or an app, though those involve inputting all your accounts, and it can be a chore that can lead to an incomplete budget or just giving up.

Mine is simpler and easier. I use a Google doc (not a spread sheet, just a doc), and each month list my bills, when they’re due, how much they are, and what income I have coming in. Once I did the first month, it was easy to cut and paste it once that month is taken care of and the next one is coming up. I’m a sucker for color coding, so bills that I must pay manually are red. Those that are automatically withdrawn from my account are yellow. Once a bill is paid, I change it to green. I do auto-pay for almost all of my bills, and have the pay date set for the end or first of the month. That way, they all come out around the same time and I don’t have to worry about what’s coming out when. I make sure that I have enough money in my account to cover them all at the end of the month.

I have separate list of credit cards, their due dates and minimum payments (though I also include the card payments in the main budget list). I pay more than the minimum, but I want to keep track and make sure that my payments are on time and I’ve taken care of what I owe in order to keep my credit score up (more on that and why it’s important later).

My budget is an evolving thing. I look at it frequently during the month, make adjustments, make sure my money is doing what it’s supposed to. You don’t have to do it my way, but you get the idea, right? There was a time in my life when I just let my bills and income cascade around me like a crazy party. A lot of the time, it was the kind of party where you wake up on a strange couch the next morning with a killer headache and wonder why you didn’t pay more attention. I don’t know why I thought that was easier than simply keeping track. In the many years now that I’ve kept track, I find I can do a lot more with a lot less money. No strange couch. No headache. No wondering.

2. Become financially literate

Don’t just take my word for what do do – educate yourself about money and how it works. Once you get to be an adult, you assume you know everything you need to about money. Most people know less than they think they do, however.

Less than half of consumers, for instance, understand financial risk, which is a huge factor in how you think of, and spend, your money. Study after study has found that the more financially literate you are, the better your financial decisions and the more money you have. It doesn’t matter if your income is incredibly low or incredibly high, understanding how your money works in your life and the marketplace is crucial.

You can up your financial literacy in many ways.

There’s information all over the internet, but if you want specifics, there are some good places to start.

Your bank, credit union, or credit card provider’s website may have a financial literacy or “Your money” page. Don’t use this as your only source, however. A business is looking for business, and may have good advice, but not all the information you need. Topics you want to learn more about include earning, consuming, saving, managing debt, insurance, investing and financial risk.

Some solid resources for financial literacy are:

- The U.S. Department of Treasury’s My Money five and tools page has information on earning, saving, protecting, spending and borrowing money. It also has calculators, budgeting worksheets and checklists. The page is also available in Spanish (as of this writing, at least).

- Community Centers for Financial Wellness & Education

- NHJump$tart Coalition

- Consumer Financial Protection Bureau financial education resource page

- The New Hampshire Banking Department

- Front Door Agency in Nashua offers free financial wellness workshops.

- Southern New Hampshire Services Your Money in Action offers a three-part course for those who qualify.

3. Understand your credit score and credit cards

Everyone is entitled to see their credit reports for free. It used to be that you could get a copy of your reports at no cost once a year, but you can see them online weekly.

You also used to have to pay to see your credit score more than once a year. Now most banks and credit card companies offer it as a free service and you can look at it every day, or as many times a day as you want to, for free.

If you haven’t checked out your credit reports or credit score in a while, do it. Credit reports are put together by the three credit reporting agencies Equifax, Transunion and Experian. If you’ve ever had a credit card, your history of payments for it is on them. Ditto for any other loans you’ve taken out, including car loans and mortgage. Have you missed payments, defaulted on a credit card, your car was repossessed, did a debt settlement, filed for bankruptcy, or were foreclosed on? That’s all on there.

It’s important to check that there aren’t any errors (they tell you how to correct those), but also important to see what anyone who’s considering lending you money is seeing. It’s not only lenders and credit card companies who are checking out your credit history, by the way. Insurance companies, landlords, even potential employers, can look. A low score could mean a higher insurance premium, a higher security deposit or not getting that job offer. Each agency has a slightly different report and score, so it’s important to check out all three.

There are a lot of apps now that claim they can boost your credit score, but they’re not going to do anything you can’t do on your own. The biggest factor in a credit score is paying your credit card and other loan bills on time, or anything else reported to the credit agencies, on time. That’s one reason to check your report – to see who’s reporting.

Another big factor that goes into a credit score is credit utilization. That’s how much you’re allowed vs. how much you use. If your cards are always maxed out, that’s high utilization. Lenders like to see 30% or less. The length of time you’ve had accounts (longer is better), the more variety (better to a mix, not just credit cards) and how many applications to borrow money you’ve made in the last two years also paly a part. Your income, savings, and assets have nothing to do with your credit score, though do have to do with how lenders look at your finances.

If you’re looking to borrow money, debt-to-income ratio is a big factor. If the amount you pay in credit card and other debt bills monthly is more than 40% of your monthly income, that means higher interest, a lower amount you can borrow, or even rejection.

Credit card debt is out of hand in America. Studies show that consumers don’t get, or don’t pay attention to, how revolving credit ramps up debt. Interest is charged on your balance daily. If you don’t pay the balance off every pay period, that interest is added to what you owe.

If you haven’t looked at your credit card statement, check it out. It’s available online if you don’t get it in the mail. Look at the section that shows how much you’ll pay if you only make minimum payments, and how long it’ll take to pay it off. That’s if you don’t use the card when you’re making the payments. It could scare you straight into not using the card.

If you want to get a handle on credit card debt, start one card at a time by making payments as large as you can on one card (if you have more than one), while making smaller payments on the others. If they all have similar interest rates, attacking the one with the highest balance first will have the most long-term financial impact, since the interest is accumulating more debt on that card. It may feel better, though, to attack the one with the smallest balance and get it paid off. It’s up to you.

A debt management plan through a nonprofit credit counseling agency will do the same thing, but also work with your card companies to lower interest and fees, and make the payments smaller. You pay the debt management company one fixed payment a month, and they pay off your cards. It takes three to five years, and there’s a small monthly administrative fee, usually $25 to $50, included in your monthly payment. The initial discussion with a credit counselor at one of these agencies is free. Be sure that their website ends with .org. If it’s .com, it’s not nonprofit credit counseling agency, it’s a for-profit debt settlement company.

Debt settlement is a for-profit business in which you pay less than what you owe – usually about 40%-60%. This has financial repercussions, though. The agencies also charge fees, much higher than those for a nonprofit debt management plan. It’ll hurt your credit score in a couple of ways. Most for-profit debt settlement companies have you stop paying your credit cards as they negotiate with the card companies for your payoff, which means your credit reports will show extended non-payment. Once the settlement is complete, your credit reports will show that you didn’t pay the entire amount you owed. Both will stay on your reports for seven years. You’ll also have to pay income taxes on the amount that you didn’t pay back if it’s more than $600, since the IRS considers that income.

To future-proof your finances, whatever your credit and debt looks like, understand how credit works, know what you owe, and if it’s a problem, take steps that are financially sound to deal with it.

4. Put your tax return to good use

If you’re getting a tax return, I know how tempting it is to go on a spree. I’m not saying not to treat yourself to a night out, or buy some treat you’ve been putting off, or even take a trip. That said, I’m going to be the boring kill-joy who tells you to make good use of it, especially if you’re lying awake nights worrying about the price of eggs or how you’re going to pay the rent or get that toothache taken care of.

A tax return is your own money. The U.S. Department of Treasury has been holding onto it, interest-free, for the year. I used to scoff at the goody-two-shoes who would tell me how that money, invested, would’ve gained interest, blah blah blah. Now that I’m self-employed, I don’t overpay the government anymore, but I still remember the thrill of getting a tax return. The excitement is worth not accumulating interest. I totally get that.

That said, don’t blow it. If you don’t have any pressing bills or big credit card debt you can use it for, put at least a portion in a certificate of deposit account, where it will build interest and you won’t be able to touch it.

If you have high credit card debt, pay it down or off. Try not to use the credit card, and if you do, pay the balance every month. Not having that monthly credit card payment will be extra money for other stuff, much better than a one-time spree with a tax return. Using it for something boring like a dental visit, better tires for your car, or something else you need to do but have been putting off, will also pay off in the long run, since ignoring those things will all cost you more later.

Everyone’s financial situation is different, but using at least some of your tax return to make your financial life more sustainable is a good move that will pay off long-term.

5. Do something smart for better finances, but don’t be a chump

Almost everyone can be doing something smarter with their money. Let’s take a look at some of the basic things you can do, but also some of the myths that may seem smart but will just cause problems.

Everyone should have an emergency savings account. If you’re living paycheck-to-paycheck, it’s hard to do. But find a way to put some money away every week, then try like hell not to touch it. I know that when you don’t have any money, there’s an emergency every week. But deal with those the best you can and keep the savings going if possible. It’ll pay off in the long run.

Contribute to your 401(k) if you work at a place that has one. You may not like reducing your take-home pay, but your future self will be so glad you did. Particularly if Social Security and Medicare get altered in any negative ways in the coming years. “Old age” may seem a long ways away, but it’ll be here before you know it, and you want to be able to afford it.

Insure yourself. New Hampshire doesn’t require car insurance, but one accident can send you into a financial abyss. Insure your car as though you lived in a state that requires it, including liability, collision and uninsured motorist insurance. If you’re self-employed or your employer doesn’t offer health insurance, make use of the Affordable Care Act (Obamacare). The premiums are tied to your income, and it’s worth it. Even if you have a high deductible, you’ll still be covered for certain things and pay less for prescription drugs. One illness, injury or necessary prescription can send also send your finances into a spiral if you can’t pay.

Review your subscriptions. Like all those ads say, you probably ARE paying more than you should for streaming and other subscriptions. Go through your accounts and see what you’re paying and get rid of what you don’t want. By the way, that’s what any of those apps would do, too. You’ll have to input all your accounts, and if you want them to do everything you can do for free, it’ll cost you money.

Get a second job, gig work or sell something, but only if it works for you. Many consumer columns about cutting expenses and saving money suggest those options, but in a way that makes them sound like sure things. They aren’t always. Before you make a commitment or budget in that extra income, look into any drawbacks. Will a second job schedule cause you more stress? Cost you more in transportation or child care? Is driving for DoorDash or Uber going to generate enough money? What are the costs associated with making and selling your awesome cupcakes from home? With freelancing? I wrote a column with tips for freelancers that you may want to check out, even if it’s going to be a part-time gig.

Once you understand your finances, you’ll think of things you can do better. You don’t have to do everything at once, but do something and be smart about it. If it will cost money – particularly apps that seem like they’ll make it easier to budget, cut subscriptions or improve your credit score – make sure you’re just not falling into another money-wasting hole.

Bottom line, no matter what’s going on with the economy and policies that have an impact on your wallet, you’re the one who controls your money. It’s up to you to make your financial life as sustainable as possible, so that when the things you can’t control get out of hand, you still have a foundation.

Scam of the Month

Instead of highlighting a particular scam this month, to continue the theme of the column, I want to remind everyone to stay smart.

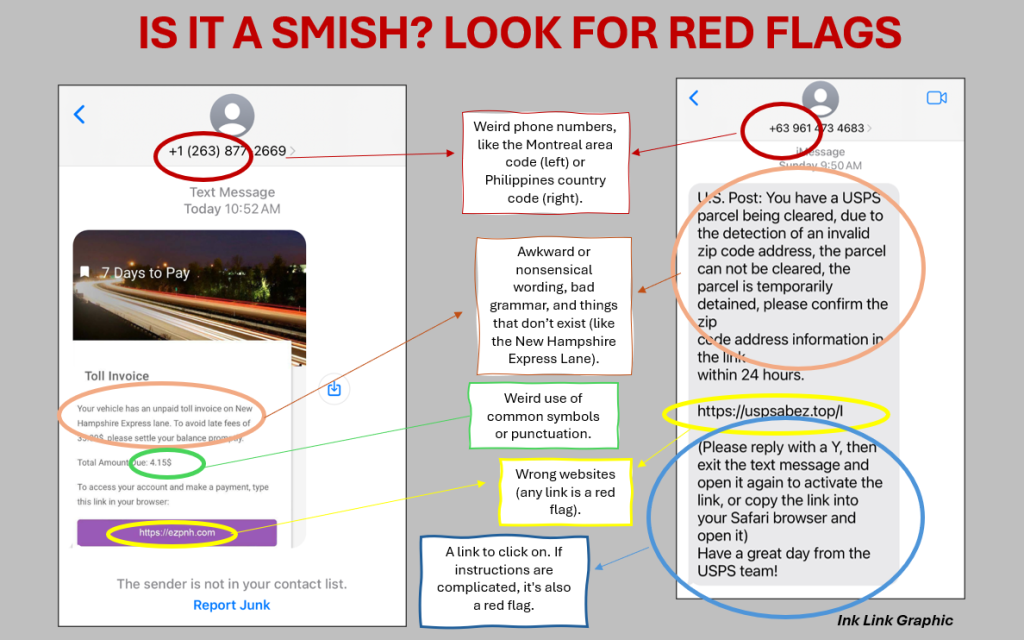

The proliferation of artificial intelligence has made scams much more sophisticated and they’re coming at you from everywhere. The old tell-tale signs of bad grammar, punctuation and weird wording aren’t as obvious anymore, since AI is writing a lot of scam texts and emails.

I got a very real-looking letter telling me that my student loans may be eligible for forgiveness. Yay! Except for the fact that I graduated from college in 1983. I think I had my student loans paid off within five or so years, but if I defaulted or something, that ship sailed a long time ago.

I also got a very real looking email that used a real name of a California agent offering to represent me in getting my mystery novels produced as film projects. Every writer’s dream! It looked real. Her name was real. But some research uncovered that it was a total scam. (Long story, but I wrote about it last month.)

The latest scams love to lock onto something that’s big in the current culture – student loan forgiveness, tax return scams this time of year, “protecting” your Social Security, work from home jobs where you can make $500 an hour. If you were researching something, like a new car or a home equity line of credit, be prepared for emails, texts and phone calls related to it. Some are legit, some are scams and it’s hard to tell them apart.

In general, don’t click on any links in an email or text; don’t send anyone money, or worse, buy gift cards to “pay” them; don’t respond to a social media message that says something like “hi, how are you?” or “Let’s have coffee” or anything else unless it’s clear exactly who it came from and it’s not a spoof, but really that person. Even something that seems innocuous – like that social media message – is an opening to something worse if it’s from a scammer.

Here are just a few of the tips from AARP, FTC, FBI and my own experience that I’ve offered in the past year on how to recognize scams:

- They tell you not to talk to your bank

- A text from a “local” bank, agency or business has an area code or country code from somewhere else. (An E-ZPass scam text I got had a Montral area code; one purportedly from the U.S. Post Office had a Philippines country code, for instance)

- An invoice or notice of payment from a business or agency is from a gmail address, or has multiple recipients. (Best Buy, McAfee or your bank will not be using an email address or send a notice about payment or anything else to a bunch of people).

- Pressure to act immediately.

- Anything that tells you to pay with gift cards.

- They ask for your username, password or account number.

- It’s from law enforcement, the IRS, a court, or other government agency wanting you to pay something. No government agency or law enforcement will ask you to pay by text, email or phone call. If you get something like this, call the agency’s real phone number – find it online and make sure it’s the real website – and find out what’s going on.

- They want to share your screen.

The FTC, FBI and AARP all have pages on how to avoid scams and scads of information on what to look for and how to protect yourself. Check them out.