It’s Your Money: Consumer Financial Protection Bureau shutdown is a big setback for consumers

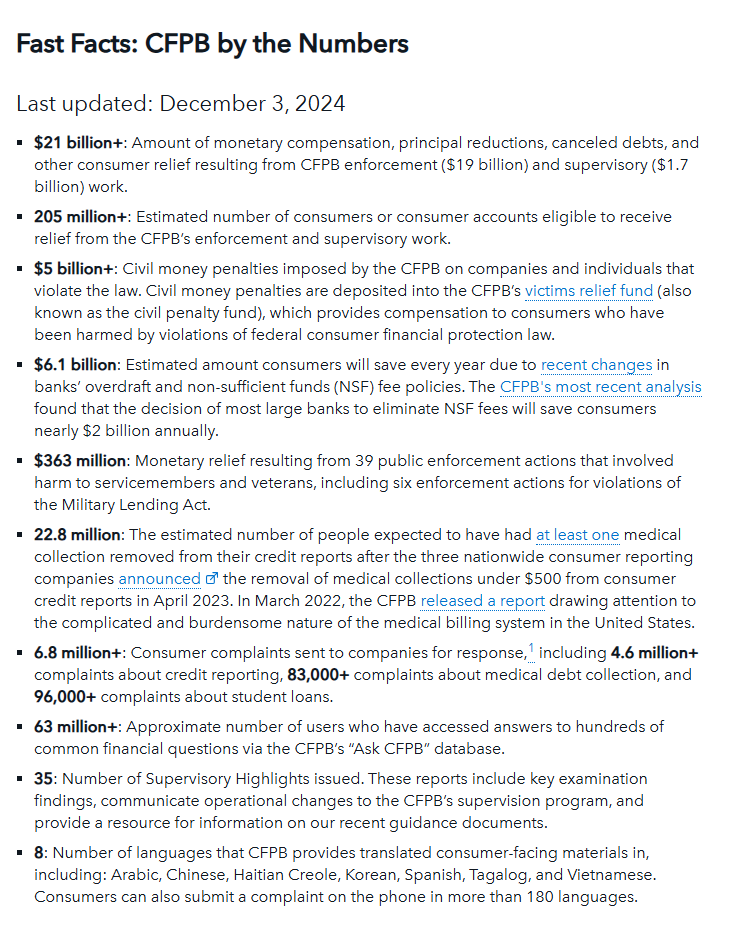

The agency that has saved, or returned to, consumers more than $21 billion in junk fees and other rip-offs over the past decade and a half will no longer be looking out for you.

NEWS: Trump administration shuts down Consumer Financial Protection Bureau.

WHAT IT MEANS TO YOU: The agency that has saved, or returned to, consumers more than $21 billion in junk fees and other rip-offs over the past decade and a half will no longer be looking out for you.

In the three years I’ve been writing this column, I’ve referenced the Consumer Financial Protection Bureau many times. As a writer whose job it is to help you understand money and how it’s working for you out there in the world, it’s hard not to. The CFPB’s aim is to protect consumers from profit-focused big business and banking, industries that don’t pay a lot of attention to how the average person will be affected by what they do.

As of this writing, if you go to the CFPB’s website, you get an error page, though all its tabs and links still seem to be working and its information is still intact.

Russell Vought, the director of the Office of Management and Budget, Saturday night ordered the agency to stop work on proposed rules, suspend the effective dates on rules that were finalized but not yet effective, stop investigative work and not begin any new investigations. Vought has been called a “chief architect” of Project 2025, which calls for the agency’s elimination.

Elon Musk’s agency, DOGE, last week gained access to the agency’s human resources, procurement, and finance systems, several news outlets reported. DOGE is not an official federal department, and doesn’t have authority to shut down programs or access sensitive information at federal agencies, but that hasn’t stopped it.

The CFPB handles consumer complaints and, most recently, said it sends about 25,000 complaints a week to the companies cited by consumer’s in the agency’s online complaint portal. If you click on “submit a complaint,” that page is still active. It’s not clear, though, what will happen if you do submit a complaint, since Musk’s team now has oversight of it.

Let’s take a look at what the CFPB does, what it’s shutdown could mean, and how it would affect you.

Question: What exactly is the CFPB?

Answer: The CFPB was created by Congress in 2010 to provide a single point of accountability for enforcing federal consumer financial laws and protecting consumers in the financial marketplace. This happened in the wake of the massive financial fraud that led to the Great Recession in 2007-2009. It’s funded through the Federal Reserve, unlike most federal agencies, which are funded by Congress. This is to keep its rule-making and enforcement independent of the political process (theoretically, we now see). The law governing the CFPB sets a cap for its budget, which is adjusted for cost of living. The U.S. Supreme Court voted 7-2 last may that the funding method is constitutional. A bill last year by a group of Republican senators, the Consumer Financial Protection Bureau Accountability Act, would have shifted funding to Congress, but didn’t pass. Vought said this weekend he will order the Federal Reserve not to issue the next CFPB operating payment.

Question: What is the Office of Management and Budget, and can it shut down the CFPB?

Answer: The OMB is an Executive Branch office, which means it works for the president. It’s responsible for implementing the financial end of presidential orders. The CFPB is an independent agency, but its director is appointed by the president. CFPB Director Rohit Chopra was fired by Trump Feb. 1, and Scott Bessent, the secretary of the treasury, was appointed director. He immediately ordered the agency to stop all regulatory work. On Friday, after he was approved by the Senate as OMB director, Vought was named acting director. He ordered the agency to stop all work and it’s headquarters in Washington, D.C., to close, at least for this week. Meanwhile, DOGE staffers were busy at work accessing the agency’s systems.

While the CFPB can only be eliminated by Congress, since it was created by Congress, the director can decide what it does. Vought has ordered it to do nothing.

Q: How will this affect me?

A: In December, I wrote about some of the recent actions the CFPB has taken that will have a direct impact on the wallets of many Americans. Many of those will be paused now, or done away with. Once the CFPB finalizes a rule, it has to go through a federal process before it is enacted. This seemingly now won’t happen for any of these that were far enough along to have been finalized by CFPB.

A quick look at some recent, or planned, CFPB actions that likely will not go forward:

- Trump had vowed to cap credit card interest rates at 10% (the average is now well over 20%). The CFPB had started work on that move before the shutdown.

- A rule scheduled to go into effect in October that would cap bank overdraft fees at $5 or whatever it cost the bank to administer the fee, as well as require banks to provide more transparency to consumers about overdraft fees and how they work.

- An investigation that began last year into how junk fees are increasing mortgage closing costs, driving up the cost of buying a house.

- A rule finalized by the agency in November that would require payday advance and payment apps like Apple, CashApp, Google, Amazon, PayPal, Block, Venmo, Zelle – which process more than 13 billion consumer payments a year – to follow the same federal laws that applies to large banks, credit unions, and other financial institutions. This includes allowing consumers to opt out of data-collection practices that the apps use, dispute transactions and dispute accounts being suddenly closed or frozen.

- A rule proposed in December to rein in data brokers that sell sensitive personal and financial information. This includes limiting the sale of personal identifiers like Social Security and phone numbers, and ensuring financial data, like income, is only shared for legitimate purposes (facilitating a mortgage approval, for instance), and not sold to scammers targeting people who are in financial distress. The rule would clarify that when data brokers sell sensitive consumer information they are acting as a consumer reporting agency under the Fair Credit Reporting Act

- A rule launched in December that would address the harmful effects of inaccurate credit reporting that negatively affects survivors of domestic, elder and other financial abuse. Financial abuse is a major factor in more than 90% of domestic abuse situations, trapping people in relationships. They often must sign documents under the threat of violence, ruining their financial lives and making it even more difficult to escape, Chopra said in December. “Expanding identity theft protections could help survivors rebuild their financial lives and would ensure that our credit reporting system is not used as a tool for domestic and elder abuse.”

- A rule, finalized by the CFPB in January, that prohibits medical debt that’s in arrears from being included on credit reports. The CFPB found that people with otherwise good credit saw their credit score drop an average of 20 points when medical debt went on their credit report. While there’d been a reduction in medical debt reporting to the credit agencies in recent years, about 15 million Americans were still affected by it, many of them low-income, Black and Hispanic consumers who could not afford unexpected medical bills.

- A lawsuit CFPB filed against Bank of America, JP Morgan and Wells Fargo – which all own the payment app Zelle – charging that cyber fraud on the app has cost consumers nearly $1 billion.

- A lawsuit CFPB filed against Capital One, the claims the bank misled customers about savings account interest rates, cheating them out of an estimated $2 billion.

- A CFPB order that Block, which operates payments app Cash App, to refund and pay other redress to consumers up to $120 million and pay a penalty of $55 million into the CFPB’s victims relief fund.

- Uncertainty about the future of the CFPB victim’s relief fund, which has paid millions to defrauded consumers, as well as provides financial education resources. The money to fund it comes from penalties from companies and individuals who violate federal consumer law.

Q: If the CFPB does all that work to protect consumers, then why would anyone want to shut it down?

A: The agency has been a target of Republicans, banking and large corporations since it was first created because they don’t believe it should have the power to regulate how they do business. It doesn’t help that it was first conceived by Sen. Elizabeth Warren, D-Mass., who wrote a paper proposing the agency in 2007. She is a financial progressive wildly disliked by conservatives. The agency has been a target for more than a decade of those who think that it is regulatory overreach, , and it has been subject to many legal and congressional attacks.

Billionaires like Mark Zuckerberg, of META (Facebook) and Marc Andreessen, a hugely successful software developer, have spoken out against the agency, and Warren’s role. Banks and other lenders were particularly unhappy with the recent overdraft fee rule; billionaires don’t want their companies regulated, particularly as they pursue mining users’ personal information.

It’s also been reported that Elon Musk, who is driving much of the Trump administration’s recent actions, wants to get rid of the agency because its recent crackdown on payment apps it would get in the way of him launching on he’s planning for X (formerly Twitter). His oversight of the agency means that he also has inside information about Cash App and other similar payment apps that the agency was investigating, or had in the past.

Q: So, what’s next?

A: On Sunday, the National Federal Employees Union, which represents 155,000 federal employees, filed lawsuits against Vought to block the shutdown and against DOGE to keep it from accessing employee information, charging it has violated the Privacy Act. The Privacy Act sets limits on what employee information can be accessed without their consent.

Rep. Maxine Waters, D-Calif., the ranking Democrat on the House Financial Services Committee, said in a news release Saturday that Congress will fight the shutdown, but it’s not clear yet what they will be able to do.

“Musk’s takeover of the CFPB is a five-alarm crisis and a frightening violation of millions of Americans’ data privacy,” Waters said. “As it stands, Musk can now see the personal information of people who, after being swindled by bad actors, reached out to the CFPB in a moment of desperation. This includes all of their documents that they may have provided in search of relief, like bank statements, credit card information, Social Security numbers, and even medical information.

“Why the richest man in the world is working to gut the agency that has returned $21 billion to harmed American consumers is simple. Not only does this shield his billionaire buddies from accountability for defrauding working-class families, but Musk also has billions of dollars at stake with many of his companies deeply tied to federal government contracts.”

She points out Musk’s X cash payment plan, adding, “In addition to having access to the consumer data of millions of Americans, Musk can now illegally steal sensitive business information about other American companies in the same industry. It doesn’t get any more corrupt and anti-American than that.

“My Democratic colleagues and I will not stand by as a corrupt, crooked billionaire illegally takes control of an agency designed to protect working-class families from criminals like him. We will fight this every step of the way.”

We’ll keep you posted as things progress.

You can reach Maureen Milliken at mmilliken@manchesterinklink.com